Every seventh Russian borrows money “before payday”

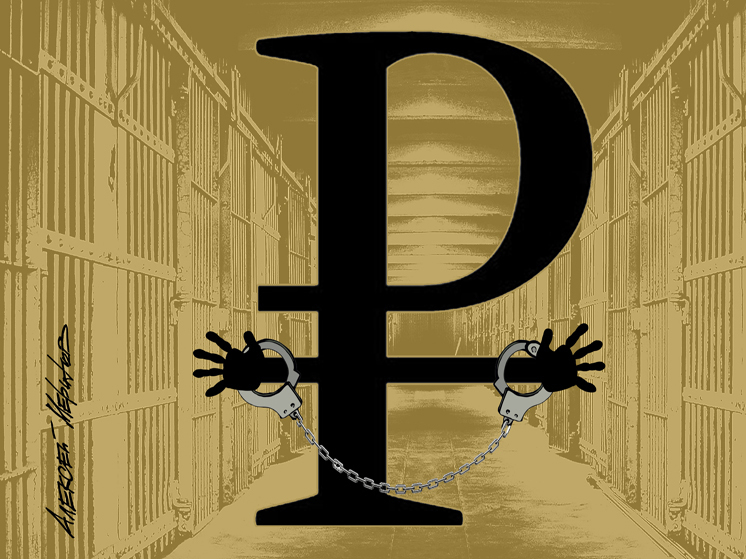

The total volume of microloans in Russia in the third quarter of this year reached 348.1 billion rubles. And although the figure is not comparable to the 30 trillion that the population owes to commercial banks, there is little good in it. The situation does not fit into the dry framework of statistics, indicating formidable risks both for the economy and for the mass of ordinary citizens with collapsed incomes — that is, for all those for whom the services of microfinance organizations (MFOs) are today becoming almost the only way to make ends meet .

The total number of MFO clients increased by 2.7 million people, to 19.8 million (this is, in fact, a seventh of the population of the Russian Federation), and the volume of microloans issued is almost 20% per year. In many ways, this dynamics is associated with the massive transition of bank clients to the microfinance sector, explain participants in this market. At the same time, analysts recall that in 2023 the Central Bank tightened regulatory standards for microfinance organizations.

In particular, the share of loans issued by microfinance organizations to borrowers with a debt burden ratio (DLI) above 80% should not exceed 35% of the established lending limits. The regulator also limited the maximum rates on microloans from 1% to 0.8% per day. Plus, the maximum value of the total cost of the loan was reduced from 365% to 292% per annum, and the maximum amount of all payments was reduced to 130%. Nevertheless, Russians continue to increasingly actively take out short-term (“payday”) and medium-term loans in the amount of 8-13 thousand rubles. Some do this in order to maintain a more or less decent standard of living against the backdrop of inflation and a decline in their purchasing power. Others — so as not to find themselves in a position where they have nothing to feed their family.

Yes, unlike banking practice, you can still get money from microfinance organizations “without leaving the cash register”: you don’t need a personal income tax certificate from work, you don’t need to indicate the contacts of your friends, the number of loans is not limited. The problem is a fundamentally different degree of risk.

“Of course, in the case of MFOs, the risks for each individual borrower are much higher,” says Artem Deev, head of the analytical department at Amarkets. — So far, this area is not as strictly regulated as banking. Often, people who have been refused a loan by the bank resort to its services, either because of high debt load, or because of low solvency, or for both reasons at once. And Russians are increasingly taking out microloans remotely, which fits perfectly with the trend of the market moving online and is therefore actively supported by MFOs themselves.”

Meanwhile, the share of microloans whose payments are overdue (for a period of more than 90 days) is increasing. According to the Scoring Bureau for May-June, it reached 46%. In the previous April review, the share of “bad” microloans was less than 40%. According to Deev, for citizens whose incomes are falling amid inflation, this is fraught with falling into a deep debt hole, and for the state — increasing problems in the field of consumer lending, a reduction in the circulation of money in the real sector and a slowdown in the economy as a whole.

“We are talking about an obvious trend, which is expressed in a steady increase in the volume of microloans issued,” says Igor Nikolaev, chief researcher at the Institute of Economics of the Russian Academy of Sciences. — And trends, as a rule, are more important than absolute indicators. Taking into account the current level of the Central Bank key rate, bank loans are becoming prohibitively expensive, sometimes reaching up to 25%. This forces Russians to turn to microfinance organizations, where it is also much easier to get money. True, the conditions for interest and payment terms there are not at all as liberal as in banks. And if people fail to pay, they are forced to find the necessary amounts somewhere, get into new debts, and ultimately, doom themselves to inevitable bankruptcy. From the point of view of socio-economic activity, such citizens are actually lost to the economy and the country.”

Note that, in theory, the MFO institution is intended for everyday situations that do not entail dramatic consequences. Let's say the car was taken to the impound lot, there are 300 rubles in your pocket, and three days until payday. During this time, a round sum will accrue, and if you borrow 5 thousand rubles from a microfinance organization, you can pick up the car immediately, and the overpayment at a rate of 0.8% will be negligible. In reality, people fall into the microfinance trap seriously and for a long time. Moreover, those who do not have enough wages to meet basic needs, primarily food. Today there are 45% of them in Russia, according to surveys of recruiting agencies.